Introduction

With Prime Minister Suga’s October 2020 declaration of carbon neutrality by 2050 and the subsequent adoption of the Green Growth Strategy Through Achieving Carbon Neutrality by a government advisory council, the momentum toward decarbonization in Japan has taken a leap forward. Along with “decarbonization” and “carbon neutral,” the terms “electric vehicle” and “hybrid” are appearing more than ever. Of particular note are articles on the growth of electric vehicles in the European automobile market. The fact that EVs are increasing in Europe suggests growth with the same momentum in Japan’s near future, too, as the country aims to go carbon neutral. Will this intuition prove to be on target? I’d like to consider this a bit.

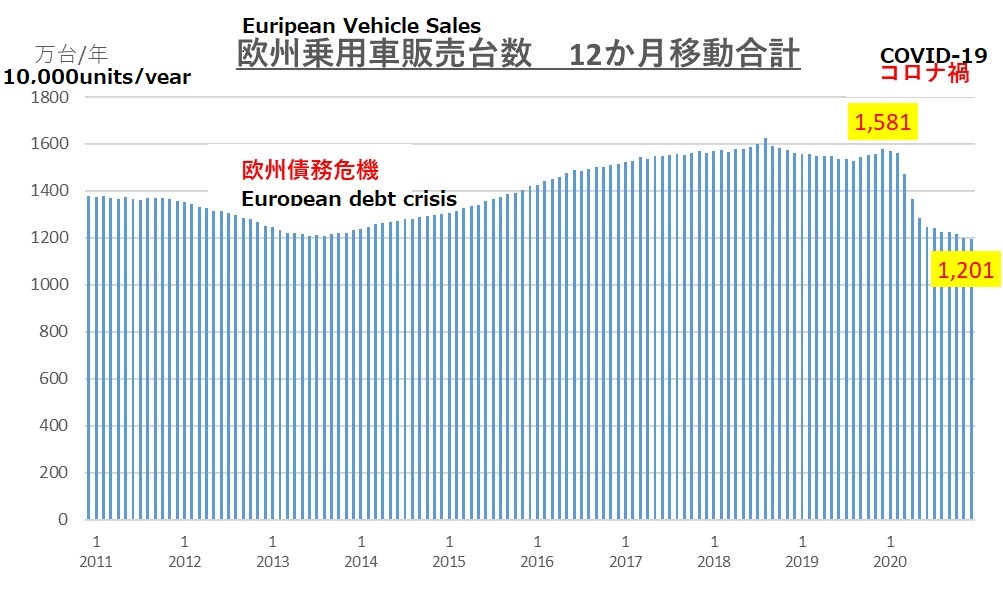

European passenger automobile market

(Source: by SCAB based on ACEA statistics)

First, I took a look at overall movements in the European passenger car market. Looking at the past decade, it can be seen that the market stagnated due to the European debt crisis around 2012, then gradually expanded through 2019 before the impact of the coronavirus in 2020. This graph reveals a market contraction of about 24%, from about 15.81 to 12.01 million vehicles, over the course of a year. However, as noted at the beginning, electric vehicles are showing rapid growth. Accordingly, I graphed Moving Annual Total in sales by power source of car. What does “decreased by about 24% but increasing” even mean?

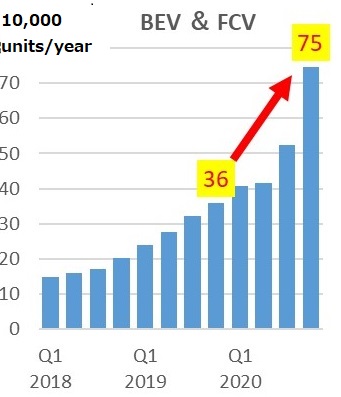

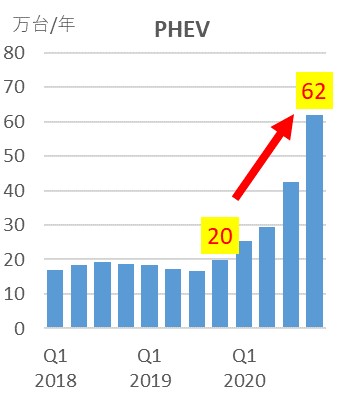

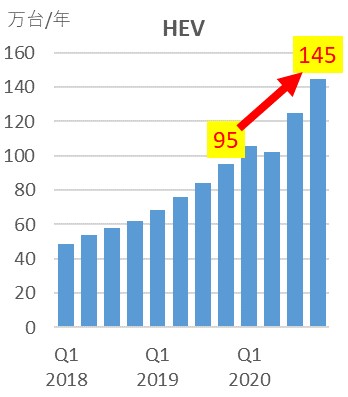

Source: Created by SCAB based on ACEA statistics

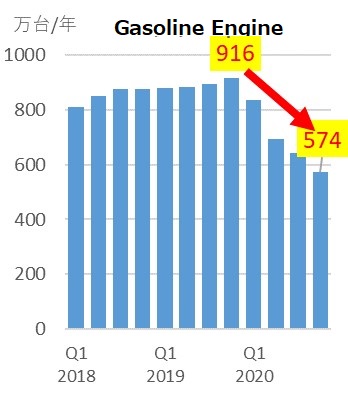

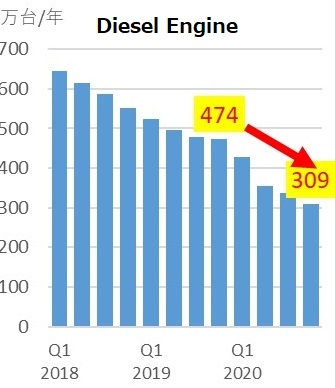

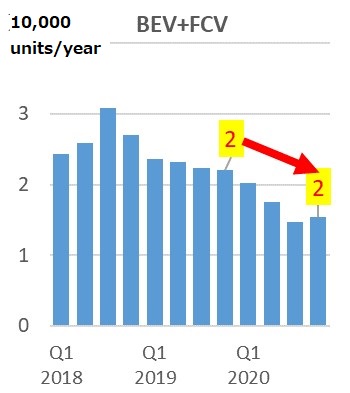

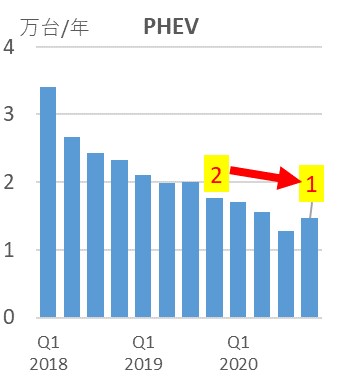

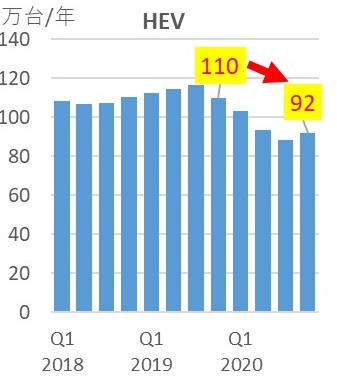

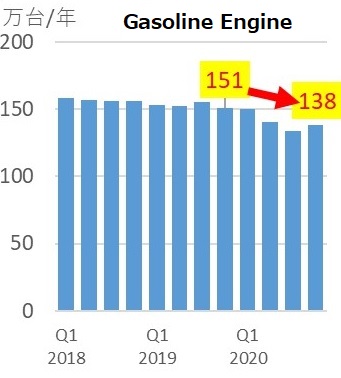

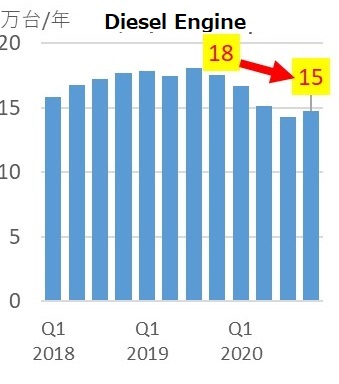

Looking at the graphs of sales by power source, from left are BEV & FCV, PHEV, HEV, gasoline automobiles, and diesel automobiles. The graphs show that sales of electric vehicles – BEV & FCV, PHEV, and HEV – are on an upward trend, while sales of gasoline and diesel internal combustion engine (ICE) automobiles are on a downward trend. Quarterly figures are used to accommodate available published statistics, but the graphs should provide a sense of the momentum of the respective changes.

We can also compare Q4 2019 and Q4 2020 to quantitatively understand the change over the year.

As noted above, an annual market of about 15.71 million units at the end of 2019 shrunk to about 12.01 million units at the end of 2020, a decrease in one year of 3.7 million units annually.

During this period, the number of gasoline-powered vehicles decreased by 3.42 million units per year (-37%) from 9.16 million to 5.74 million units per year, while diesel automobiles decreased by 1.65 million units per year (-35%) from 4.74 million to 3.09 million units per year. In total, these two mainstay categories decreased by 5.07 (3.42 + 1.65) million units per year (-36%).

By contrast, BEV & FCV sales increased by 390,000 units per year (+108%) from 360,000 to 750,000 units per year, PHEV sales increased by 420,000 units per year (+ 301%) from 200,000 to 620,000 units per year, and HEV sales increased by 500,000 units per year (+53%) from 950,000 to 1.45 million units per year. In total, the three categories increased by 1.31 (0.39 + 0.42 + 0.50) million units per year (+87%). The media has reported this as a significant increase in the number of electric vehicles in Europe.

The COVID-19 pandemic’s attack on the European economy took place from the spring of 2020, with the greatest economic hit said to have occurred in Q2 of 2020. Accordingly, graphs of moving totals are expected to show recovery in the first half of 2021. Looking at the above graphs of the five categories of power source, the three graphs for electric vehicles show a robust upward trend despite a degree of decline in Q2 of 2020. This trend will likely continue. Conversely, diesel vehicles have been on a continuous downward trend even before the pandemic, owing to the effects of the emissions scandal.

Given the trend of BEV and PHEV subsidies in Europe as a measure to promote carbon neutrality, it is speculated that sales of HEVs may decrease. An opinion has also emerged suggesting that the medium to long term could see a ban on sales of PHEVs and HEVs, which emit exhaust gases. As such, positioning and future trends surrounding PHEVs and HEVs will be points to watch in Europe.

Passenger automobile sales by power source in Japan (4 x quarterly moving totals)

Source: Created by SCAB based on ACEA statistics

Japanese passenger automobile market

I used statistical values published by the Japan Automobile Manufacturers Association to create graphs similar to those for Europe.

Starting with the graph at the left, we can see that the BEV & FCV category is on a downward trend. The market size is still small, however, and with the category still in its infancy, I believe that the change can safely be considered slight. Similarly, PHEVs show a decline but are also a nascent category. Next, the HEV graph shows that the market size had exceeded 1 million units per year, but has now fallen below that threshold. Looking at the two ICE categories, gasoline-powered automobiles continue to drift downward, while diesel-powered automobiles are declining from a peak. Neither has increased, but their decreases have not been as pronounced as in Europe.

As seen here, the overall sales trend is currently downward overall due to business cycles and the COVID-19 pandemic. In terms of electrification, the Japanese market is lagging behind Europe, with electrification not yet becoming apparent as a direction.

Summary

It was confirmed above that electric vehicles have embarked upon a strong upward trend in Europe despite the headwind of the COVID-19 pandemic.

Conversely, electric vehicles have yet to show signs of a significant increase in Japan. The government has only recently set a carbon neutrality goal and launched its Green Growth Strategy, however, so effects may take a bit of time to appear in sales stats.

Attention will also focus on the movements of automobile manufacturers. As an example, somewhat expensive PHEVs have not taken off in Japan as have HEVs, which have been the target of subsidies. In many countries in Europe, meanwhile, subsidies have targeted only PHEVs and not HEVs. Accordingly, many European brands are placing their focus on PHEVs instead of HEVs and are increasing their number of PHEV models. Considering that European brand cars command a certain market share in Japan, particularly in major metropolitan areas, it is possible to imagine European brands replacing their gasoline and diesel automobiles with PHEVs in Japan.

Just as Tesla has planted an image of BEVs, European automobiles may prove to be the trigger that makes PHEVs a big thing in Japan.

I hope to continue watching future trends.