As countries around the world seek to meet the targets set in the Paris Agreement, Europe, Japan and China are enforcing regulation on automobile fuel consumption and emissions of greenhouse gases (GHG) (See attachment 1). European and Chinese regulations include a share target for electric vehicles (in practice, Battery Electric Vehicle (BEV) and Plug-in Hybrid Electric Vehicle (PHEV); Fuel Cell Vehicle (FCV) numbers only a small amount of the total). Automotive manufacturers who want to sell their products in these regions are strongly encouraged to obtain or achieve electric vehicle technology and review their product lineup.

In response to this, last year European car manufacturers launched or announced to launch luxury BEV one after another. BEVs like the Jaguar I-PACE, Porsche Taycan, Mercedes-Benz EQC and Audi e-tron offer high performance at a high sticker price and come equipped with large capacity batteries. These BEVs offer mileage per charge that will satisfy luxury car users, as well as utilize the flexibility offered by a BEV powertrain to employ unique packaging for both drive performance and an interior feel that would be unattainable in a traditional internal combustion engine (ICE) vehicles. Automobile journalists are raving that these are the “ideal” cars.

Meanwhile, in terms of mainstream consumer vehicles, essential to promulgate BEVs among the ordinary users, Volkswagen(VW) has commenced the production of “ID.3” on its dedicated platform for EV “MEB” (Modularer E-Antriebs-Baukasten = “Modular Electric Drive Matrix” in English). This model is produced in the factory in Zwickau, eastern Germany, which is being modified to be the factory dedicated for EV, to be completed by late 2020. VW is positioning the ID.3 as its core product following the Beetle and Golf, with a choice of models reaching 330km, 420km, and 550km on a full charge (depending on the capacity of battery). The base model (variation of 330km) is quite ambitiously priced at under 30,000 Euros, claiming to offer a 290km travel distance on a 30-minute charge if using a 100kW rapid charger (now starting to become mainstream in Europe).

The Zwickau plant is scheduled to produce 330,000 vehicles annually of six VW Group brands based on MEB in the future. The VW Group announced that it will bring, across its group of companies, about 75 new BEV models and 60 new HEV (Hybrid Electric Vehicle)/PHEV models to market by 2029. The company announced that it will invest 33B EUR in electric mobility alone between 2020 and 2024. At the moment, VW is the only major OEM among Japanese, American, and European manufacturers that has announced plans for the construction of a dedicated plant exclusively for BEV. This gives a glimpse of the extent of the bet the company is making on BEV.

Meanwhile, in terms of Japanese OEMs, in addition to the Nissan Leaf available on the market since 2010, Honda announced the “Honda e” at the Frankfurt Motor Show in September, and Mazda announcing the “MX-30” and Nissan announced the “Aria Concept” model at the Tokyo Motor Show in October and November 2019. These are expected to appear on the market this year. Toyota established the Toyota ZEV Factory in November 2018 with the aim of developing and planning EV products. It announced plans to use the site to further BEV alongside its partners (Subaru for medium SUVs and Daihatsu and Suzuki for compact cars). However, the Honda e and MX-30 have a comparatively small battery capacity and are designed as city commuters, whose cruising range is around 200 km at a full charge. This has led to mixed opinions. Someone extols them that “they are innovatively designed to eliminate excess weight that contributes to worse electric economy by eschewing unnecessary batteries,” while someone criticizes that “these are half-hearted products simply seeking to meet regulatory levels.”

Automobile manufacturers are always demanded for the development of technologies that meet both regulatory and customer requirements. As regulations are tightened, improving fuel efficiency and reducing GHG are pressing challenges. It is apparent that they cannot survive without tackling to reduce GHG emissions.

On the other hand, although it is likely in the long-term that all electricity will be obtained from renewable energy generation, short- and medium-term GHG reduction methods depend heavily on local characteristics such as power grid configuration (in 2030, there will still likely be areas on Earth where there is no electricity). If renewable energy becomes the main source of power, this will lead to the issues in terms of a gap between the highly volatile supply and the demand (as well as the storage in the battery, hydrogen, as well as FCV might be one of the solutions for the issues / I will write about them on the different occasion).

The price of lithium-ion batteries for electric vehicle is expected to be reduced, which is already taken into account for the prospect of diffusion of BEV, but the reserve and supply of raw materials are not unlimited. These are beyond the scopes of what the automotive industry can accommodate, but true reduction of GHG emission on the basis of “Well to Wheel” or “Life Cycle Assessment” cannot be achieved if these factors are ignored.

Given these circumstances, it might be worth considering what powertrain mixes are best in terms of minimizing GHG derived from automotive over the next 10 years.

Attempts to accurately evaluate BEV/PHEV CO2 emissions

At present, the calculation methods and approaches to CO2 emissions in BEV/PHEV vary by country and region.

Well to Wheel

The following table (equivalent fuel consumption of HEV, PHEV and EV) is an excerpt from papers published by experts on the matter. Note that, in Europe, CO2 emissions from power generation are not considered in calculations (BEV are counted in CAFE as not producing any CO2 emissions). Despite the fact that the driving mode has been changed from the conventional NEDC (new European driving cycles) to the current WLTP (Worldwide harmonized Light vehicles Test Procedure), given that the CO2 emissions produced when generating electricity used to charge BEV/PHEV are being ignored, this cannot be recognized as an accurate measure of CO2 emissions.

At first glance, meanwhile, Japan and the United States seem to be accurately calculating CO2 emissions of BEV/PHEV unlike Europe, but in fact, the power generation efficiency of power plants is being ignored (assumed as 100%). Performing an accurate calculation thus requires taking the above into account.

Moreover, the calculation method used by experts (the “Hori method”) assumes a value higher (50% — see comparison figures for Japan and the US for the Nissan LEAF using the “Hori method”) than the actual power generation efficiency stated for Japan (about 40%). Therefore, the fuel economy of EV/PHEV is actually worse than the Hori method figures above.

<Equivalent fuel consumption of HEV, PHEV and BEV>

|

Summary |

PHEV fuel consumption data equivalent calculation method

|

HEV Toyota Prius ZVW30 (2009) |

PHEV Toyota Prius PHV (2012) |

PHEV Mitsubishi Outlander PHEV (2013) |

EV Nissan LEAF ZE0 (2010) |

|

Rechargeable power |

Mileage on single charge |

0km |

26.4km |

60.2km |

200km |

|

Hybrid fuel economy |

Hybrid variable consumption rate |

32.6km/L |

31.6km/L |

18.6km/L |

– |

|

Europe |

Considers only the amount of gasoline consumed (disregards the amount of electricity consumed) |

32.6km/L |

65.0km/L |

63.4km/L |

∞km/L |

|

Japan/USA |

Gasoline consumption + power consumption converted into equivalent gasoline consumption using heat value (Assuming 100% efficiency of a power plant) |

32.6km/L |

44.6km/L |

35.5km/L |

73.7km/L |

|

Hori Method |

Gasoline consumption + power consumption converted into equivalent gasoline amount using energy used to produce power |

32.6km/L |

35.1km/L |

24.0km/L |

36.8km/L |

(Source: Prepared by SCAB per Dr. Masao Hori, “Plug-in hybrid vehicle fuel consumption rates.” Journal of Society of Automotive Engineers, 2014, Vol. 68, No. 7.)

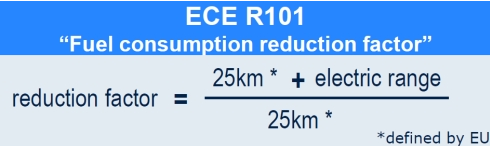

For PHEV, a calculation method of “deemed 1/3 of CO2 emissions from internal combustion engine vehicles provided the vehicle can run for 50 km or more continuously only with battery” is used (specified in ECE R101 below). This was a political determination made based on the inability of European car manufacturers s to comply with the 95g/km (NEDC) regulations slated to be introduced in 2021.

Japan evaluates BEV/PHEV using the Well to Wheel method, as indicated in the Report on New Fuel Efficiency Standards for Passenger Vehicles published by the Ministry of Land, Infrastructure, Transport and Tourism on June 25, 2019. Incorporating CO2 emissions from power plants into calculations of automotive fuel economy is a major step forward in terms of total CO2 reduction.

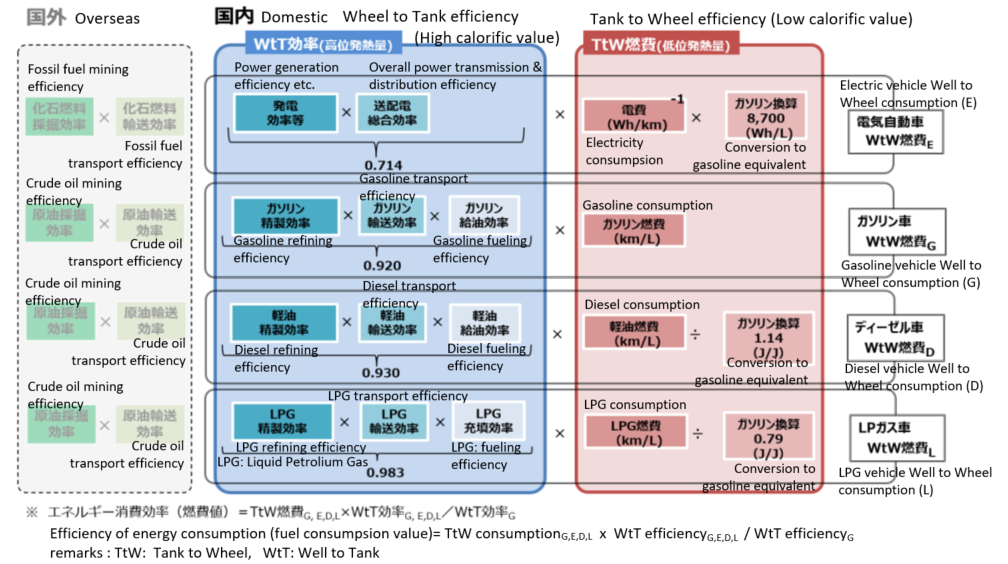

Fuel economy regulations scheduled for 2030 in Japan will use the fuel consumption calculation method seen in attachment 2. However, accurately assessing actual output hinges on the energy used to manufacture vehicles, something as yet not taken into account.

Life Cycle Assessment

As mentioned above, the current European regulations ignore CO2 emissions produced when generating electricity used to charge BEV/PHEV, but this is being reconsidered, as well as motions being made to evaluate emissions in terms of Life Cycle Assessment (LCA) that would span production through discarding of a vehicle.

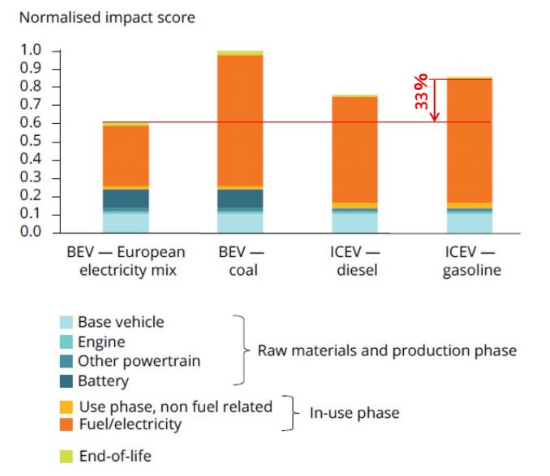

According to the BEV’s LCA assessment published by the European Environment Agency in November 2018 (figure below), even if CO2 emissions from battery manufacturing are added to the LCA assessment, BEV’s CO2 emissions are still lower than ICE vehicles. However, if the comparison is HEV instead of ICE vehicles (assuming fuel overconsumption of ICE vehicles being ▲ 33%; see red text below), the LCA evaluation is almost equivalent. Switching from NEDC mode’s fuel/power consumption value, which deviates greatly from actual fuel consumption, to WLTP, would in turn reverse the outcomes for HEV and BEV. In addition, the challenge of BEV is that when charging BEV with coal-fired power, the total CO2 emissions will be significantly higher.

*)EEA Report | No.13/2018

Electric vehicles from life cycle and circular economy perspectives

Excerpted from “TERM 2018: Transport and Environment Reporting Mechanism (TERM)” report.

Conclusion

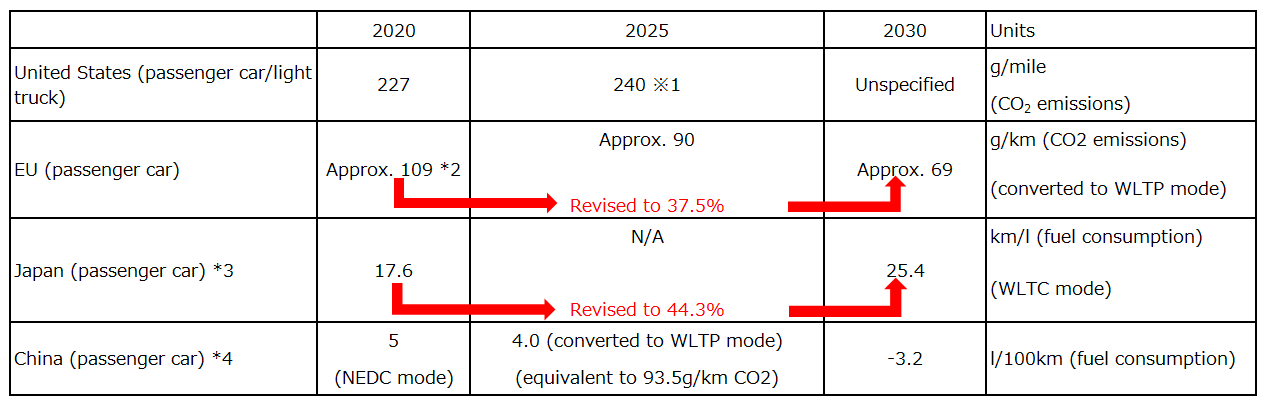

In Europe, CO2 emissions regulations for 2030 are being considered in parallel with the application of above LCA method.

Following the 95g/km (NEDC mode) regulations from 2021, the next goal is a further reduction of 37.5% for a 60 g/km (equivalent) level in 2030, followed by a full transition to carbon neutral vehicles in 2050. The 2030 regulations are generally considered to be impossible to achieve without BEV and PHEV, but it remains unclear what specific regulatory value will be used — Tank to Wheel, Well to Wheel, LCA, or something else. If CO2 emissions are calculated by LCA in 2030, the CO2 emissions of BEV would increase by the amount of CO2 emitted during battery production. As a result, not only does this do away with the advantage over HEV, the CO2 emissions of BEV are close to the regulatory value. Even with European car manufacturers’ putting heart and soul into developing BEV, there are concerns that it will be difficult to meet the CAFE regulations. (In that case, the suspicion would be that it would lead to a sudden rule change, something the EU seems to excel at.)

Since the launch of the 1st generation Toyota Prius in 1998, the strong hybrids system by Japanese car manufacturers have continued to evolve at a steady pace. Toyota’s THS II technology was used by Honda and Nissan to bring products to market, both of which are function as EV, and have a significant improvement in fuel efficiency. Manufacturing costs have also decreased through mass production, and Toyota’s THS II is believed to be competitive with diesel, which faces increased costs due to regulatory compliance. Last year, Toyota announced its withdrawal from the diesel market in Europe. As a competitor to diesel cars, the new Corolla was equipped with a 2.0L hybrid engine.

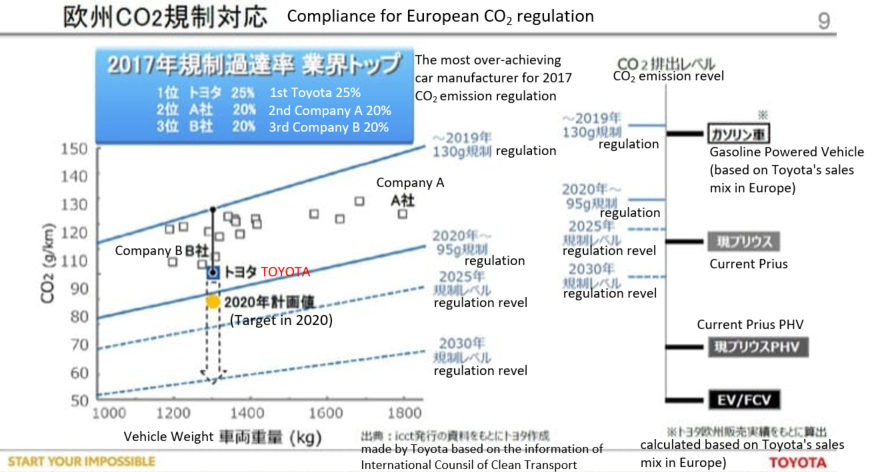

Excluding Toyota, which sells a considerable amount of strong hybrid vehicles in Europe, with the foregoing Tank to Wheel regulation, the current technology’s powertrain mix is unable to accommodate the standards set by this European regulation (see attachment 3).

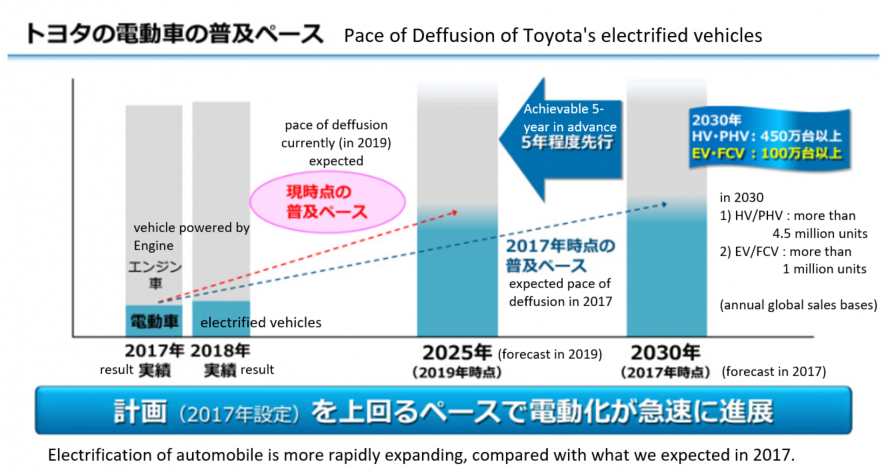

In June of last year, Toyota announced plans to achieve by 2025, five years earlier than previously forecast for 2030 (as announced in December of 2017), penetration of electric vehicles of 4.5M+ HEV/PHEV and 1M+ BEV/FCV (see attachment 4). There was no mention of figures for 2025 and beyond, but in view of the penetration of power plants utilizing next-generation batteries and hydrogen or renewable energy (especially in Japan), Toyota’s figure above — a ratio of 50% electric vehicle sales to the whole and 20% for BEV/FCV within Electric Vehicle — seems to be the optimal solution for minimizing GHG for the time being.

(Attachment 1)

Trends in Fuel Economy and GHG Regulations

*1: In US federal GHG regulations, vehicles with a model year from 2021-2026 are temporarily subject to eased restrictions per the provisions of the Safer Affordable Fuel Efficient Vehicles Rule for Model Years 2021-2026 (SAFE regulations) (this was jointly proposed by the NHTSA and EPA in August 2018 and enforced on September 2019.) The SAFE regulations, in addition to easing GHG regulations, invalidate California’s proprietary ZEV regulations, but California has collaborated with other states to bring suit against the Federal Government (as of September 2019), with the situation in flux.

*2: Replacing the 2020 regulatory figure (95g/km (NEDC mode)) with the estimated value for WLTP mode. The basis for regulatory figures is “Regulation 2019/631” (published in the EU Journal on April 25, 2019)

https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32019R0631

Moreover, Regulation 2019/631 includes a benchmark of Zero Emission Vehicle/Low Emission Vehicle (CO2 emissions of 50g/km or less) for 2030 of “35% share.”

*3: Per the “Report on New Fuel Efficiency Standards for Passenger Vehicles” published by the Ministry of Land, Infrastructure, Transport and Tourism on June 25, 2019.

https://www.mlit.go.jp/report/press/jidosha10_hh_000217.html

This year, the Ministry of Land, Infrastructure, Transport and Tourism and Ministry of Economy, Trade, and Industry are expected to revise the standards per applicable legislation.

While the 2030 fuel economy standard is a 44.3% improvement over the 2020 figure, 19.2km/l was already achieved in actual 2016 figures, so the substantive improvement from 2016 to 2030 is 32.4%. In addition, the report states that BEV/PHEV is evaluated using the Well to Wheel approach (the fuel economy of BEV does not equal ∞ km/l, so it is more stringent than the figure on paper).

*4: Regulatory figures for 2025 and 2030 are based on the “Energy Saving and New Energy Vehicle Technology Roadmap” created in October 2016. The roadmap cites the sales target for new energy-efficient vehicles (BEV, PHEV, and FCV) as 7% in 2020 and 40% in 2030.

The 2025 fuel economy value is slated to be announced in its final form in the coming days as part of the CAFC regulations’ 5th phase.

(Attachment 2)

Calculation of Well to Wheel fuel economy per new Japanese fuel consumption standards

Excerpted from June 25, 2019 findings by the joint meeting (on fuel consumption standards) of the Energy Saving Subcommittee Automotive Regulatory Standards Working Group of the Energy Saving and New Energy Sub-working Group of the Advisory Committee for Natural Resources and Energy and the Automotive Emissions Standards Subcommittee of the

Automotive Section of the Traffic and Land Transport Sub-working Group of the Traffic Policy Group

(Attachment 3)

(Attachment 4)